FDI capital grew strongly

According to Nhat Viet Securities Company (VFS), in 2023, foreign investment capital (FDI) registered in Vietnam will grow strongly by 32,1% to 36,61 billion USD, equivalent to the 3-year average. before the Covid-19 pandemic, it was 36,46 billion USD. This shows that Vietnam is the world's leading FDI attraction, when global FDI, especially developing countries, is still struggling to recover from a 40% decrease during the Covid-19 pandemic.

Of which, newly registered FDI reached more than 20,1 billion USD, an increase of 62% over the previous year and accounting for more than 87% of registered FDI capital, the highest in the past 5 years. At the same time, registered FDI also focuses more on processing and manufacturing industries. These data show that foreign cash flow is promoting more investment in production and processing in Vietnam following the trend of shifting supply chains.

At the same time, thanks to upgrading relations with the US to a Strategic Partnership, the high-tech sector (including cloud computing, semiconductor components and AI) in Vietnam will be strengthened and may attract more attention. FDI capital in the near future. Therefore, this Securities Company believes that the demand for renting industrial parks (IZs), warehouses (NK), and factories (NX) in Vietnam will still increase strongly in 2024.

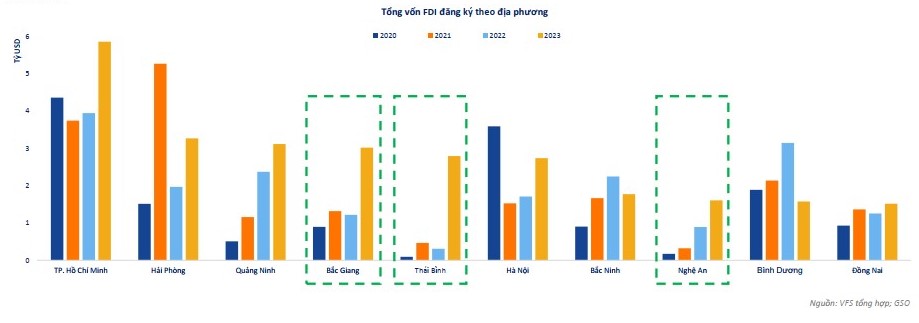

Statistics by locality, the notable point is that the total registered FDI capital increased dramatically in localities that are the northern level 2 industrial park markets such as Bac Giang, Thai Binh and some central provinces such as Nghe An. The growth of registered FDI capital in these localities is mainly new registration and increased registration at large industrial production, processing and manufacturing projects.

Typical examples are the Thai Binh LNG gas power plant projects of the joint venture Tokyo Gas Company - North Kyuden Electricity Company of Japan - Truong Thanh Group of Vietnam with a total investment capital of nearly 2 billion USD; The project is invested by investor Radiant Opto - Electronics Corporation (Taiwan) to build Radiant Opto - Electronics Vietnam Nghe An Factory in VSIP Nghe An Industrial Park.

"With the supply of industrial park land in tier 1 markets growing slowly, the trend of FDI capital flows looking to tier 2 markets will continue in 2024," VFS commented.

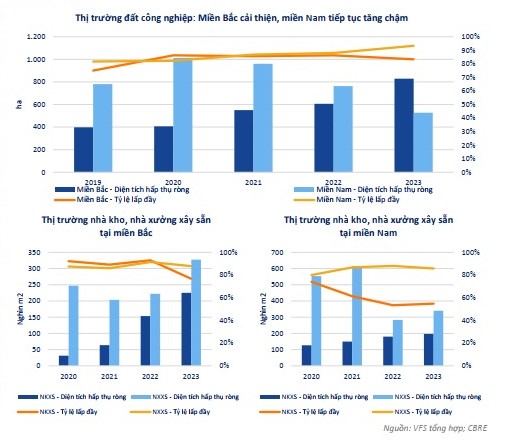

Regarding supply, this unit said that the supply of industrial land in the Northern tier 1 market in 2023 has recorded an improvement when the occupancy rate decreased from 86% (2022) to 83% (in the third quarter). /2023), while rental demand maintains with net absorbed land area increasing by 37% compared to the whole of 2022.

Similarly, the supply of ready-built warehouses (NKXS) and ready-built factories (NXXS) in the North also increased significantly, causing the occupancy rate to decrease from over 90% (in 2022) to 77% and 88%, respectively. % despite the net absorption area still growing for the second consecutive year, 2% and 47% respectively compared to 48.

In contrast, the supply of industrial land in the Southern tier 1 market continues to increase slowly, causing the occupancy rate to increase from 88% in 2022 to 93% by the end of 2023 in the context of a decrease in net absorbed industrial land area. 31% compared to 2022.

Supply continues to improve in 2024

However, the NKXS and NXXS markets both recorded better developments. NXXS occupancy rate decreased slightly from 88% (2022) to 86% although net absorption area increased by about 20% compared to 2022, showing an improvement in supply. The NKXS market in the South has become more vibrant as the occupancy rate increased slightly from 53% to 55% and the net absorption area increased by about 9% compared to 2022.

It is forecasted that industrial park real estate supply will continue to improve in 2024 thanks to legal reforms such as Resolution 33/NQ-CP dated March 11, 03 of the Government and the amended Land Law. Accordingly, difficulties in site clearance and conversion of land use purposes when establishing a new industrial park will gradually be removed.

“With the Government's orientation according to the Decision on Allocation of National Land Use Planning targets for the period 2021-2030, vision to 2050, 5-year National Land Use Plan 2021-2025, total land area Industrial parks nationwide will reach about 152,8 hectares by 2025," VFS said.

Regarding rental prices, this Securities Company believes that the average rental price of industrial park real estate in tier 1 markets in Vietnam will continue to increase in 2023. Rental prices in the North will increase steadily by an average of 2%. Each quarter when the market is vibrant, many large transactions are recorded thanks to the supply chain shift trend. Meanwhile, after accelerating in the first quarter of the year, rental prices in the South have decelerated as the market cooled, with a lack of large transactions due to the lack of supply.

Calculated by locality, the average rental price in the South is higher than the rental price in the North. Among them, Ho Chi Minh City is still the locality with the highest rental price, about 250 USD/m2/remaining lease term, about 100 USD higher than Hanoi - the place with the highest average rental price in the North. .

“It is forecasted that the average rental price in both the North and the South will likely continue to slow down in 2024 when supply is expected to increase in 2024, fluctuating around 135 - 140 USD respectively. /m2/Remaining lease term in the North and 195 - 200 USD/m2/Remaining lease term in the South", VFS commented.

Assessing the prospects of businesses in the industrial park real estate industry, VFS believes that the majority of leading businesses in the industry have negative growth when projects have not been handed over on schedule and projects have not met their deadlines. Record revenue once or no new rental transactions arise. These are all businesses that have leased land funds in the primary market and are expanding to the secondary market.

Meanwhile, the majority of businesses with outstanding growth are small and medium capitalization businesses. The common point of these businesses is that they have a ready land fund in the secondary market and have been able to anticipate shifting market trends.

Source: Business Forum